CEN/TS 16931-3-4:2020

(Main)Electronic invoicing - Part 3-4: Syntax binding for UN/EDIFACT INVOIC D16B

Electronic invoicing - Part 3-4: Syntax binding for UN/EDIFACT INVOIC D16B

This documents specifies the mapping between the semantic model of an electronic invoice, included in EN 16931-1 and the ISO 9735 (UN/EDIFACT) syntax. For each element in the semantic model (including sub-elements or supplementary components such as Identification scheme identifiers) it is defined which element in the syntax is to be used to contain its information contents. Any mismatches between semantics, format, cardinality or structure are indicated.

Elektronische Rechnungsstellung - Teil 3-4: Umsetzung in die Syntax UN/EDIFACT INVOIC D16B

Dieses Dokument legt die Zuordnung (en.: mapping) zwischen dem semantischen Modell einer elektronischen Rechnung nach EN 16931 1 und der Syntax aus ISO 9735 (UN/EDIFACT) fest. Für jedes Element im semantischen Modell (einschließlich Unterelemente oder Ergänzungskomponenten wie Identifikationsschema-Kennungen [en: Identification scheme identifiers]) wird definiert, welches Syntax-Element für seine Informationsinhalte verwendet werden muss. Nichtübereinstimmungen zwischen Semantik, Format, Kardinalität oder Struktur werden angezeigt.

Facturation électronique - Partie 3-4 : Correspondance syntaxique pour les factures - Schéma D16B UN/EDIFACT

Elektronsko izdajanje računov - 3-4. del: Povezava sintakse za UN/EDIFACT INVOIC D16B

General Information

- Status

- Published

- Publication Date

- 28-Apr-2020

- Technical Committee

- CEN/TC 434 - Project Committee - Electronic Invoicing

- Drafting Committee

- CEN/TC 434/WG 5 - Syntax bindings

- Current Stage

- 9093 - Decision to confirm - Review Enquiry

- Start Date

- 16-Apr-2024

- Completion Date

- 28-Jan-2026

Relations

- Replaces

CEN/TS 16931-3-4:2017 - Electronic invoicing - Part 3-4: Syntax binding for UN/EDIFACT INVOIC D16B - Effective Date

- 05-Jun-2019

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

- Effective Date

- 28-Jan-2026

Overview

CEN/TS 16931-3-4:2020 - Electronic invoicing - Part 3-4: Syntax binding for UN/EDIFACT INVOIC D16B - defines how the European core invoice semantic model (EN 16931-1) is mapped into the UN/EDIFACT INVOIC D16B syntax (ISO 9735). The Technical Specification specifies, for each semantic element (including sub-elements and identification scheme identifiers), which EDIFACT segment, composite or data element must carry the information. It also records any mismatches in semantics, format, cardinality or structure and supplies code lists and validation artefacts to support interoperable implementations.

Key Topics and Requirements

- Syntax binding: Concrete mapping rules from the EN 16931-1 semantic data model to the ISO 9735 (UN/EDIFACT) INVOIC D16B syntax.

- Data types and structures: Guidance on EDIFACT composites, segments and data elements to represent invoice information reliably.

- Codes and identifiers: Defined code lists (e.g., ISO 3166-1 country codes, ISO 4217 currency codes, ISO/IEC 6523 identifier schemes) and use of UN/EDIFACT code qualifiers.

- Validation artefacts: Information to support syntactic and semantic validation of EDIFACT invoices against the core invoice model.

- Mismatches: Explicit identification of semantic, structural and cardinality differences between the semantic model and EDIFACT representation, with notes on implications for implementation.

- Examples and annexes: Practical EDIFACT examples (multiple line items, taxes, payments, minimum/maximum content) and a normative annex listing code lists for consistent usage.

Applications and Who Should Use It

- E-invoicing software vendors implementing EDIFACT INVOIC messages to comply with the European core invoice model (EN 16931-1).

- Public administrations and procuring entities required by Directive 2014/55/EU to receive e‑invoices consistent with the EN 16931 semantic model.

- Enterprise IT and integrators building B2B/B2G interfaces that translate between internal invoice data models and UN/EDIFACT.

- Service providers and clearing houses that validate, route or transform invoice messages across borders. Using CEN/TS 16931-3-4:2020 helps ensure interoperability, regulatory compliance and predictable data exchange when using EDIFACT INVOIC D16B.

Related Standards

- EN 16931-1 - Semantic data model of core invoice elements (reference semantic model)

- CEN/TS 16931-3-1 - Methodology for syntax bindings

- CEN/TS 16931-3-2 and 3-3 - Syntax bindings for UBL and UN/CEFACT XML Cross Industry Invoice

- ISO 9735 (all parts) - EDIFACT application syntax rules

Keywords: CEN/TS 16931-3-4:2020, electronic invoicing, UN/EDIFACT INVOIC D16B, ISO 9735, EN 16931-1, syntax binding, e‑invoice interoperability, code lists.

Get Certified

Connect with accredited certification bodies for this standard

BSI Group

BSI (British Standards Institution) is the business standards company that helps organizations make excellence a habit.

NYCE

Mexican standards and certification body.

Sponsored listings

Frequently Asked Questions

CEN/TS 16931-3-4:2020 is a technical specification published by the European Committee for Standardization (CEN). Its full title is "Electronic invoicing - Part 3-4: Syntax binding for UN/EDIFACT INVOIC D16B". This standard covers: This documents specifies the mapping between the semantic model of an electronic invoice, included in EN 16931-1 and the ISO 9735 (UN/EDIFACT) syntax. For each element in the semantic model (including sub-elements or supplementary components such as Identification scheme identifiers) it is defined which element in the syntax is to be used to contain its information contents. Any mismatches between semantics, format, cardinality or structure are indicated.

This documents specifies the mapping between the semantic model of an electronic invoice, included in EN 16931-1 and the ISO 9735 (UN/EDIFACT) syntax. For each element in the semantic model (including sub-elements or supplementary components such as Identification scheme identifiers) it is defined which element in the syntax is to be used to contain its information contents. Any mismatches between semantics, format, cardinality or structure are indicated.

CEN/TS 16931-3-4:2020 is classified under the following ICS (International Classification for Standards) categories: 35.240.20 - IT applications in office work; 35.240.60 - IT applications in transport. The ICS classification helps identify the subject area and facilitates finding related standards.

CEN/TS 16931-3-4:2020 has the following relationships with other standards: It is inter standard links to CEN/TS 16931-3-4:2017, CEN ISO/TS 16403-1:2012, EN 16931-1:2017+A1:2019, EN 17187:2020, EN 16455:2014, EN 16572:2015, CEN ISO/TS 16407-2:2012, EN 16515:2015, CEN ISO/TS 16410-1:2011, CEN/TS 16931-5:2025, CEN/TR 16931-5:2017. Understanding these relationships helps ensure you are using the most current and applicable version of the standard.

CEN/TS 16931-3-4:2020 is associated with the following European legislation: EU Directives/Regulations: 2014/55/EU. When a standard is cited in the Official Journal of the European Union, products manufactured in conformity with it benefit from a presumption of conformity with the essential requirements of the corresponding EU directive or regulation.

CEN/TS 16931-3-4:2020 is available in PDF format for immediate download after purchase. The document can be added to your cart and obtained through the secure checkout process. Digital delivery ensures instant access to the complete standard document.

Standards Content (Sample)

SLOVENSKI STANDARD

01-julij-2020

Nadomešča:

SIST-TS CEN/TS 16931-3-4:2018

Elektronsko izdajanje računov - 3-4. del: Povezava sintakse za UN/EDIFACT

INVOIC D16B

Electronic invoicing - Part 3-4: Syntax binding for UN/EDIFACT INVOIC D16B

Elektronische Rechnungsstellung - Teil 3-4: Umsetzung in die Syntax UN/EDIFACT

INVOIC D16B

Facturation électronique - Partie 3-4 : Correspondance syntaxique pour les factures -

Schéma D16B UN/EDIFACT

Ta slovenski standard je istoveten z: CEN/TS 16931-3-4:2020

ICS:

03.100.20 Trgovina. Komercialna Trade. Commercial function.

dejavnost. Trženje Marketing

35.240.63 Uporabniške rešitve IT v IT applications in trade

trgovini

2003-01.Slovenski inštitut za standardizacijo. Razmnoževanje celote ali delov tega standarda ni dovoljeno.

CEN/TS 16931-3-4

TECHNICAL SPECIFICATION

SPÉCIFICATION TECHNIQUE

April 2020

TECHNISCHE SPEZIFIKATION

ICS 35.240.20; 35.240.60 Supersedes CEN/TS 16931-3-4:2017

English Version

Electronic invoicing - Part 3-4: Syntax binding for

UN/EDIFACT INVOIC D16B

Facturation électronique - Partie 3-4 : Correspondance Elektronische Rechnungsstellung - Teil 3-4: Umsetzung

syntaxique pour les factures - Schéma D16B in die Syntax UN/EDIFACT INVOIC D16B

UN/EDIFACT

This Technical Specification (CEN/TS) was approved by CEN on 22 December 2019 for provisional application.

The period of validity of this CEN/TS is limited initially to three years. After two years the members of CEN will be requested to

submit their comments, particularly on the question whether the CEN/TS can be converted into a European Standard.

CEN members are required to announce the existence of this CEN/TS in the same way as for an EN and to make the CEN/TS

available promptly at national level in an appropriate form. It is permissible to keep conflicting national standards in force (in

parallel to the CEN/TS) until the final decision about the possible conversion of the CEN/TS into an EN is reached.

CEN members are the national standards bodies of Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia,

Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway,

Poland, Portugal, Republic of North Macedonia, Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey and

United Kingdom.

EUROPEAN COMMITTEE FOR STANDARDIZATION

COMITÉ EUROPÉEN DE NORMALISATION

EUROPÄISCHES KOMITEE FÜR NORMUNG

CEN-CENELEC Management Centre: Rue de la Science 23, B-1040 Brussels

© 2020 CEN All rights of exploitation in any form and by any means reserved Ref. No. CEN/TS 16931-3-4:2020 E

worldwide for CEN national Members.

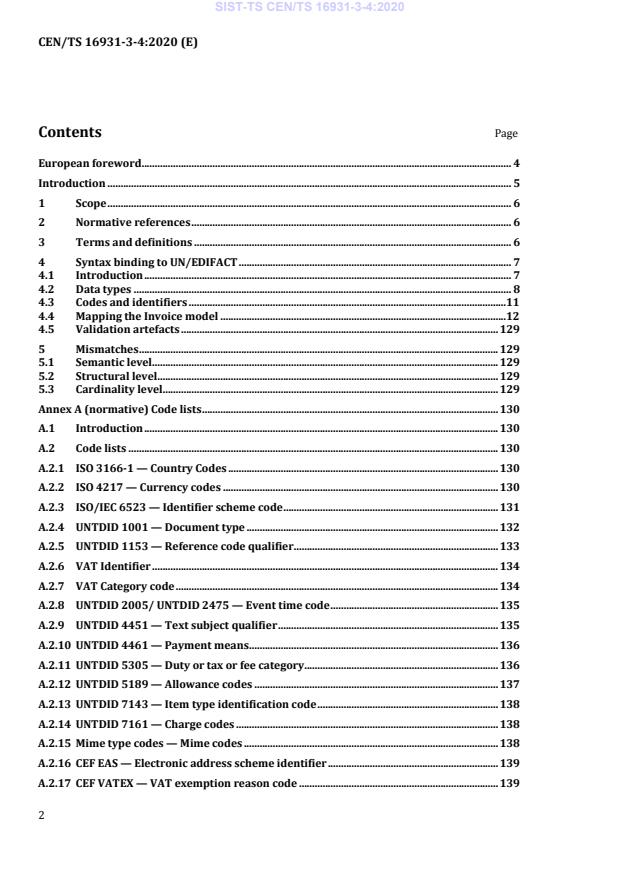

Contents Page

European foreword . 4

Introduction . 5

1 Scope . 6

2 Normative references . 6

3 Terms and definitions . 6

4 Syntax binding to UN/EDIFACT . 7

4.1 Introduction . 7

4.2 Data types . 8

4.3 Codes and identifiers .11

4.4 Mapping the Invoice model .12

4.5 Validation artefacts . 129

5 Mismatches . 129

5.1 Semantic level . 129

5.2 Structural level . 129

5.3 Cardinality level . 129

Annex A (normative) Code lists . 130

A.1 Introduction . 130

A.2 Code lists . 130

A.2.1 ISO 3166-1 — Country Codes . 130

A.2.2 ISO 4217 — Currency codes . 130

A.2.3 ISO/IEC 6523 — Identifier scheme code . 131

A.2.4 UNTDID 1001 — Document type . 132

A.2.5 UNTDID 1153 — Reference code qualifier . 133

A.2.6 VAT Identifier . 134

A.2.7 VAT Category code . 134

A.2.8 UNTDID 2005/ UNTDID 2475 — Event time code . 135

A.2.9 UNTDID 4451 — Text subject qualifier . 135

A.2.10 UNTDID 4461 — Payment means . 136

A.2.11 UNTDID 5305 — Duty or tax or fee category . 136

A.2.12 UNTDID 5189 — Allowance codes . 137

A.2.13 UNTDID 7143 — Item type identification code . 138

A.2.14 UNTDID 7161 — Charge codes . 138

A.2.15 Mime type codes — Mime codes . 138

A.2.16 CEF EAS — Electronic address scheme identifier . 139

A.2.17 CEF VATEX — VAT exemption reason code . 139

A.2.18 UN/ECE Recommendation N°20 and UN/ECE Recommendation N°21 — Unit

codes . 140

A.3 International registration authority for ISO/IEC 6523 . 140

A.4 UN/Cefact: new code request / code change request . 148

Annex B (informative) Examples . 152

B.1 Introduction . 152

B.2 Invoice with multiple line items . 152

B.3 IT equipment . 167

B.4 Subscription. 182

B.5 Domestic payment . 186

B.6 Maximum content . 191

B.7 Minimum content . 202

B.8 Taxes . 206

B.9 Electricity . 210

B.10 Licenses . 221

Bibliography . 225

European foreword

This document (CEN/TS 16931-3-4:2020) has been prepared by Technical Committee CEN/TC 434

“Electronic invoicing”, the secretariat of which is held by NEN.

Attention is drawn to the possibility that some of the elements of this document may be the subject of

patent rights. CEN shall not be held responsible for identifying any or all such patent rights.

This document supersedes CEN/TS 16931-3-4:2017.

The only change compared to the previous edition is the addition of a new annex, Annex A. This Annex

defines the code lists to be used.

This document is part of a set of documents, consisting of:

— EN 16931-1:2017+A1:2019, Electronic invoicing - Part 1: Semantic data model of the core elements of

an electronic invoice

— CEN/TS 16931-2:2017, Electronic invoicing - Part 2: List of syntaxes that comply with EN 16931-1

— CEN/TS 16931-3-1:2017, Electronic invoicing - Part 3 - 1: Methodology for syntax bindings of the core

elements of an electronic invoice

— CEN/TS 16931-3-2:2020, Electronic invoicing - Part 3 - 2: Syntax binding for ISO/IEC 19845 (UBL 2.1)

invoice and credit note

— CEN/TS 16931-3-3:2020, Electronic invoicing - Part 3 - 3: Syntax binding for UN/CEFACT XML Cross

Industry Invoice D16B

— CEN/TS 16931-3-4:2020, Electronic invoicing - Part 3 - 4: Syntax binding for UN/EDIFACT

INVOIC D16B

— CEN/TR 16931-4:2017, Electronic invoicing - Part 4: Guidelines on interoperability of electronic

invoices at the transmission level

— CEN/TR 16931-5:2017, Electronic invoicing - Part 5: Guidelines on the use of sector or country

extensions in conjunction with EN 16931-1, including a methodology to be applied in the real

environment

— CEN/TR 16931-6:2017, Electronic invoicing - Part 6: Result of the test of the European standard with

respect to its practical application for an end user - Testing methodology

According to the CEN/CENELEC Internal Regulations, the national standards organisations of the

following countries are bound to announce this Technical Specification: Austria, Belgium, Bulgaria,

Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland,

Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Republic of

North Macedonia, Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey and the United

Kingdom.

Introduction

The European Commission estimates that “The mass adoption of e-invoicing within the EU would lead to

significant economic benefits and it is estimated that moving from paper to e-invoices will generate

savings of around EUR 240 billion over a six-year period” . Based on this recognition “The Commission

wants to see e-invoicing become the predominant method of invoicing by 2020 in Europe.”

As a means to achieve this goal, Directive 2014/55/EU [5] on electronic invoicing in public procurement

aims at facilitating the use of electronic invoices by economic operators when supplying goods, works

and services to the public administration (B2G), as well as the support for trading between economic

operators themselves (B2B). In particular, it sets out the legal framework for the establishment and

adoption of a European standard (EN) for the semantic data model of the core elements of an electronic

invoice (EN 16931-1).

In line with Directive 2014/55/EU [5], and after publication of the reference to EN 16931-1 in the Official

Journal of the European Union, all contracting public authorities and contracting entities in the EU will

be obliged to receive and process an e-invoice as long as:

— it is in conformance with the semantic content as described in EN 16931-1;

— it is represented in any of the syntaxes identified in CEN/TS 16931-2, in accordance with the request

referred to in paragraph 1 of Article 3 of the Directive 2014/55/EU;

— it is in conformance with the appropriate mapping defined in the applicable subpart of

CEN/TS 16931-3.

The semantic data model of the core elements of an electronic invoice – the core invoice model – as

described in EN 16931-1 is based on the proposition that a limited, but sufficient set of information

elements can be defined that supports generally applicable invoice-related functionalities.

This CEN Technical Specification CEN/TS 16931-3-4 defines the binding of the core elements of the

invoice to the ISO 9735 syntax (UN/EDIFACT). Other subparts of this CEN Technical Specifications define

the binding method (CEN/TS 16931-3-1) and map the core invoice model to other syntaxes such as

ISO/IEC 19845 (UBL 2.1) (CEN/TS 16931-3-2) and the Cross Industry Invoice of UN/CEFACT XML

(CEN/TS 16931-3-3).

By ensuring interoperability of electronic invoices, the European standard and its ancillary European

standardization deliverables will serve to remove market barriers and obstacles to trade deriving from

the existence of different national rules and standards – and thus contribute to the goals set by the

European Commission

See https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2010:0712:FIN:en:PDF.

1 Scope

This documents specifies the mapping between the semantic model of an electronic invoice, included in

EN 16931-1 and the ISO 9735 (UN/EDIFACT) syntax. For each element in the semantic model (including

sub-elements or supplementary components such as Identification scheme identifiers) it is defined which

element in the syntax is to be used to contain its information contents. Any mismatches between

semantics, format, cardinality or structure are indicated.

2 Normative references

The following documents are referred to in the text in such a way that some or all of their content

constitutes requirements of this document. For dated references, only the edition cited applies. For

undated references, the latest edition of the referenced document (including any amendments) applies.

ISO 9735 (all parts), Electronic data interchange for administration, commerce and transport (EDIFACT) –

Application level syntax rules

EN 16931-1, Electronic invoicing - Part 1: Semantic data model of the core elements of an electronic invoice

3 Terms and definitions

For the purposes of this document, the following terms and definitions apply.

ISO and IEC maintain terminological databases for use in standardization at the following addresses:

• IEC Electropedia: available at http://www.electropedia.org/

• ISO Online browsing platform: available at https://www.iso.org/obp/ui

3.1

electronic invoice

invoice that has been issued, transmitted and received in a structured electronic format which allows for

its automatic and electronic processing

[SOURCE: Directive 2014/55/EU [5]]

3.2

semantic data model

structured set of logically interrelated information elements

3.3

information element

semantic concept that can be defined independent of any particular representation in a syntax

3.4

syntax

machine-readable language or dialect used to represent the information elements contained in an

electronic document (e.g. an electronic invoice)

3.5

business term

label assigned to a given information element which is used as a primary reference

3.6

core invoice model

semantic data model of the Core elements of an electronic invoice

3.7

core elements of an electronic invoice

set of essential information elements that an electronic invoice may contain in order to enable cross-

border interoperability, including the necessary information to ensure legal compliance

3.8

identifier

character string used to establish the identity of, and distinguish uniquely, one instance of an object

within an identification scheme from all other objects within the same scheme

Note 1 to entry: An identifier may be a word, number, letter, symbol, or any combination of those

3.9

identification scheme

collection of identifiers applicable for a given type of object governed under a common set of rules

4 Syntax binding to UN/EDIFACT

4.1 Introduction

UN/EDIFACT (ISO 9735) is a syntax for electronic data interchange for administration, commerce and

transport. UN/EDIFACT constructs are character strings in which the content of data elements is

separated by tags and delimiters. UN/EDIFACT has a hierarchical structure where the top level is referred

to as an interchange, and lower levels contain multiple messages which consist of segments, which in turn

consist of composites. The final iteration is an element which is derived from the United Nations Trade

Data Element Directory (UNTDED); these are normalized throughout the UN/EDIFACT standard .

The United Nations Economic Commission for Europe (UNECE), since the 1980s supported a number

projects to enable trade based on electronic messaging – UN/CEFACT and specific Recommendations

In UN/CEFACT, standard messages using the UN/EDIFACT syntax (ISO 9735) were developed by various

working groups across the globe to facilitate administration, commerce and transport. These messages

mimicked standard paper documents used in everyday business transactions and were called United

Nations Standard Message types (UNSMs). Today these UNSMs are the most widely used e-messages

across the globe. UNSMs are built using the United Nations Trade Data Elements Directory (UNTDED)

with reusable elements, code sets, standard composites and segments which can be configured to meet

the function of a particular message such as an Invoice.

In the IT UNECE Trade Facilitation process, formal guidance is provided by publishing Recommendations.

These Recommendations cover a wide variety of topics but some are specific to electronic messaging.

For more information please refer to http://www.unece.org/cefact/EDIFACT/welcome.html

http://www.unece.org/fileadmin/DAM/trade/untdid/texts/d423.htm

4.2 Data types

XML based syntaxes have explicit semantic meanings included in the naming of the element (e.g.

DueDate) and associate a specific data type to it (e.g. xs:DateTime). UN/EDIFACT does it the other way

around. Having a set of clearly defined data types (e.g DTM for any kind of date or time information) the

semantic meaning is added through a qualifier. The information is then given in so called data elements.

This allows implementers to easily implement type checks and then map the information to the

corresponding semantic context: First it is checked, if in this case the given date string forms a valid date

and secondly the date gets a context for instance to be the actual delivery date. Data elements can be

logically grouped into so called composites. This allows to create a logic bracket for instance to define the

type of date or time information.

To allow efficient automatic processing the semantic meaning is added by using standardized code lists.

The following example illustrates this with the invoice issue date.

DTM+2:20161214:102’

Table 1 — The DTM segment for the invoice issue date

Type Name Description Example Meaning

Segment DTM To specify date, and/or time, or period. DTM

Composite C507 DATE/TIME/PERIOD

Data 2005 Date or time or period function code 137 Issue date/time

element qualifier

Data 2380 Date or time or period text 20161013 13th October 2016

element

Data 2379 Date or time or period format code 102 Format = CCYYMMDD

element

The combination of a qualifier for the date or time type (DTM) together with the corresponding data

elements is called segment. Segments can be grouped in order to form a semantic container for instance

to define a party (e.g. buyer).

A group or segment can be mandatory (M) or conditional (C) and can be specified to repeat (cardinality).

Like a text document an UN/EDIFACT message is structures into header, details and summary section.

In order to allow a computer to recognize the difference between an XML instance and another text file

XML defines so called processing instructions. In addition the XML based standards being relevant for the

EN 16931 add groups of elements that define the type of message and the context where it is used in. In

order to be processed an XML file needs to be well-formed.

In order to have a consistend UN/EDIFACT file the same concept is applied to the UN/EDIFACT instance.

So called service segments form the outer brackets of the information being present in an UN/EDIFACT

instance. They define for instance the used version, character sets and ensure the consistency of the

message itself.

The following table shows the basic segment structure of an UN/EDIFACT invoice message. Only those

segments are shown, that are relevant for the mapping of the EN 16931.

Table 2 — UN/EDIFACT Invoice structure

Level Name Description Cardinality Example content

Service segments for the start of the instance file

+ UNA Service string adice 1.1 Basic information on the syntax like

separators

+ UNB Interchange header 1.1 Character encoding used

Header section

+ UNH Message header 1.1 Type of message, version

+ BGM Beginning of message 1.1 Type of invoice, language

+ DTM Date/time/period 1.35 Invoice issue date

+ FTX Free text 0.99 Free text applicable to the whole

message in general like Invoice note

+ SG1 Segment group 1 0.99999 References

++ RFF Reference 1.1 Previous invoice

++ DTM Date/time/period 0.5 Date of precious invoice

+ SG2 Segment group 2 0.99 Parties

++ NAD Name and address 1.1 Buyer name and address

++ FII Financial institution information 0.5 Account number

++ SG3 Segment group 3 0.9999 Party specific references

+++ RFF Reference 1.1 Buyer reference

++ SG5 Segment group 5 0.5 Contact information

+++ CTA Contact information 0.1 Contact point

+++ COM Communication contact 0.5 Telephone number

+ SG 7 Segment group 7 0.99 Currency information

++ CUX Currencies 1.1 Invoice currency

+ SG8 Segment group 8 0.10 Payment terms and conditions

++ PYT Payment terms 1.1 Payment means

++ DTM Date/time/period 0.5 Payment due date

++ PAI Payment instructions 0.1 Payment means code

+ SG16 Segment group 16 0.9999 Document allowance or charges

++ ALC Allowance or charge 1.1 Allowance

++ SG19 Segment group 19 0.1 Percentage

+++ PCD Percentage details 1.1 Allowance percentage

++ SG20 Segment group 20 0.2 Monatary amounts

+++ MOA Monetary amount 1.1 Allowance amount

++ SG22 Segment group 22 0.5 Tax information

+++ TAX Duty/tax/fee details 1.1 VAT rate

Level Name Description Cardinality Example content

+ SG26 Segment group 26 0.99 External files

++ EFI External file link identification 1.1 File name

++ COM Communication contact 0.9 External document location

++ RFF Reference 0.9 Supporting document reference

Detail section

+ SG27 Segment group 27 0.9999999 Line item information

++ LIN Line item 1.1 Invoice line identifier

++ PIA Additional product id 0.25 Item Seller’s identifier

++ IMD Item description 0.99 Item name

++ QTY Quantity 0.5 Invoiced quantity

++ ALI Additional information 0.5 Item country of origin

++ DTM Date/time/period 0.35 Invoice line period start date

++ FTX Free text 0.99 Invoice line note

++ SG28 Segment group 28 0.99 Product related monetary amounts

+++ MOA Monetary amount 1.1 Invoice line net amount

++ SG30 Segment group 30 0.25 Price information

+++ PRI Price details 1.1 Item net price

++ SG31 Segment group 31 0.10 Line item references

+++ RFF Reference 1.1 Buyer accounting reference

++ SG35 Segment group 35 0.99 Tax information

+++ TAX Duty/tax/fee details 1.1 VAT information

++ SG40 Segment group 40 0.30 Allowances and charges on line level

+++ ALC Allowance or charge 1.1 Charge indicator

+++ SG42 Segment group 42 0.1 Percentage information

++++ PCD Percentage details 1.1 Item charge percentage

+++ SG43 Segment group 43 0.2 Amount information

++++ MOA Monetary amount 1.1 Charge amount

Summary section

+ UNS Section control 1.1 Separator for summary section

+ SG52 Segment group 52 1.100 Document totals

++ MOA Monetary amount 1.1 Paid amount

+ SG54 Segment group 54 0.10 VAT breakdown

++ TAX Duty/tax/fee details 1.1 VAT rate

++ MOA Monetary amount 0.9 Tax amount

+ UNT Message trailer 1.1 End of business document

Level Name Description Cardinality Example content

Service segments for the end of the instance file

+ SG56 Segment group 56 0.99 Attached binary information

++ UNO Object header 1.1 Start of included object

++ UNP Object trailer 1.1 End of included object

+ UNZ Interchange trailer 1.1 End of instance file

This clear hierarchical structure of an UN/EDIFACT message allows to create a path expression, that looks

similar to a XPath of XML based messages. It allows to clearly identify each individual data element with

its semantic meaning in the corresponding segment or segment group. For example the path for the

invoice issue date can be given as:

INVOIC.DTM[D_2005 = ”137”].C507.2380

The path always starts with the root message type (in this case INVOIC). Then all segments, composits

and data elements, traversed through in the hierarchy are given and separated by a point. As with XPath

filter values can be given in square brackets. The example above can be read as “Give me the Date or time

or period text defined in Data Element 2380 that is part of composite C507 in segment DTM of the INVOIC

message, where the Date or time or period function code qualifier defined in Data Element 2005 is equal

to the code 137 that defines the issue date or time.“

4.3 Codes and identifiers

In order to keep UN/EDIFACT up to date to new user semantic requirements as well as impacts by

legislation UN/CEFACT publishes new libraries containing updated code lists normally twice a year. The

important point is that the underlaying syntax itself (Syntax Version 3 or Syntax Version 4) is kept stable

for many years to reduce system modifications to a minimum. Due to the underlaying methodology to

have fixed data types (segments and data elements) that are combined with codes to define the semantic

meaning structural changes are reduced to a minimum. Thus an instance file is normally backwards-

compatible. In practice many systems are implemented based on a directory version, for example D01B

(second publication of the year 2001), while they use the newest code lists are used if needed (for

instance for currencies, countries or languages.)

UN/EDIFACT uses mostly codelists maintained by UN/ECE. Every code is mapped in a specific data

element. Although for some of the code lists (e.g. Currency) the code list number is defined by UN/ECE,

the codes as well as their semantic meaning is identical to the corresponding ISO code list. Due to this

situation all codes from the model can be used as defined. The codes that have the described special

situation are listed below:

Table 3 — UN/EDIFACT codes

Semantic model UN/EDIFACT UNTDID

BT-5 UNTDID 6345

BT-6 UNTDID 6345

BT-18–1 UNTDID 1153

BT-21 UNTDID 4451

In BT-157-1 the EN 16931 references the semantic values of ISO 6523. All values that correspond to the

identification of an item are used in EDIFACT with UNTDID 7143. If the semantic codes of ISO 6523

should be used that are not intended to identify an item, it should be requested to add to UNTDID 7143.

4.4 Mapping the Invoice model

In the following table the semantic data model of the EN 16931 is mapped to the corresponding paths of

the UN/EDIFACT INVOIC message structure, as explained above. The cardinality column for the

UN/EDIFACT syntax represents the cardinality as it is defined by UN/CEFACT to illustrate differences

between the semantic data model and the respective syntax. The cardinality of the data model is taken

into account by the corresponding validation artefacts.

The model is mapped to UN/CEFACT INVOIC D14B S4. Although most existing implementations of

UN/EDIFACT are made using Syntax 3 (S3), some specific requirements of the semantic data model

necessitate using Syntax 4 (S4) for easier and more effective implementation. As no special features of

S4, for example interactive EDI, are needed for implementing the semantic data model, the instances

created using S4 will be compatible to S3 with the following differences:

— With the S4 version the service segments UNA, UNB and UNH have minor structural differences that

specifically allow the use of UTF-8 for encoding. The usage of UTF-8 encoding brings the most

possible interoperability in systems that need to implement all syntaxes from the short list. On the

other hand S3 allows the usage of many different character sets based on ISO 8859 which is a subset

of UTF-8 character set. If in cross border invoices local European languages are used the conversion

from S3 to the receiving system needs some additional effort, although this is very common practice.

— S4 also allows the direct embedding of binary data (e.g. image files or PDF-files) with the usage of the

UNO and UNP segments. With S3 it is common practice to put the UN/EDIFACT instance in an XML

based Standard Business Document Header (SBDH), which is another standard from UN/ECE. This

is for example done in the automotive industry . S4 allows a One-Syntax-Only approach for this.

The implication of choosing S4 instead of S3 on existing implementations of UN/EDIFACT in respect to

cost and effort are seen as minimal for the following reasons:

— The differences in the instance files of S3 and S4 for the data model are minor.

— As many organizations use service providers that generate or process the instance files and

especially the service segments the implication on a users system by the choice of S4 are minor.

— Embedding of binary attachments is only relevant for specific business processes. If attachments are

not embedded in the invoice process, the differences are even reduced.

— Upgrading an existing e-invoicing system to process the EN 16931 for the first time will require effort

due to the new structure, the new code definitions, and the European harmonization of business

terms, which are not common or used in every single member state.

See https://www.vda.de/en/services/Publications/4983-recommendation-on-the-transmission-of-

attachments-and-signat.html

Table 4 — Semantic model to UN/EDIFACT syntax elements mapping

ID Level Card. BT Desc. DT Path Card. Match Rules

A unique

BT-1 1 1.1 Invoice number identification of the I INVOIC.BGM.C106.1004 1.1

Invoice.

Invoice issue The date when the

BT-2 1 1.1 D INVOIC.DTM[D_2005 = ”137”].C507.2380 1.1

date Invoice was issued.

A code specifying the

Invoice type

BT-3 1 1.1 functional type of the C INVOIC.BGM.C002.1001 1.1

code

Invoice.

The currency in which

all Invoice amounts

Invoice are given, except for Use UN code list

BT-5 1 1.1 C INVOIC.SG7[D_6347 = ”2”].CUX.C504.6345 1.1

currency code the Total VAT amount 6345

in accounting

currency.

The currency used for

VAT accounting and

VAT accounting reporting purposes as Use UN code list

BT-6 1 0.1 C INVOIC.SG7[D_6347 = ”6”].CUX.C504.6345 1.1

currency code accepted or required 6345

in the country of the

Seller.

The date when the

VAT becomes

accountable for the

Seller and for the

Buyer in so far as that

date can be

Value added tax

BT-7 1 0.1 determined and D INVOIC.DTM[D_2005 = ”131”].C507.2380 1.1

point date

differs

from the date of issue

of the invoice,

according to the VAT

directive.

ID Level Card. BT Desc. DT Path Card. Match Rules

The code of the date

when the VAT

Value added tax INVOIC.DTM[D_2005 = ”3”OR D_2005 = ”35”OR

BT-8 1 0.1 becomes accountable C 1.1

point date code D_2005 = ”432”].C507.2005

for the Seller and for

the Buyer.

Payment due The date when the

BT-9 1 0.1 D INVOIC.SG8[D_4279 = ”1”].DTM.C507.2380 1.1

date payment is due.

An identifier assigned

BT- by the Buyer used for INVOIC.SG2[D_3035 = ”BY”].SG3[D_1153 = ”CR”].RFF.C506.

1 0.1 Buyer reference T 1.1

10 internal routing 1154

purposes.

The identification of

BT- Project

1 0.1 the project the invoice O INVOIC.SG1[D_1153 = ”AEP”].RFF.C506.1154 1.1

11 reference

refers to.

BT- Contract The identification of a

1 0.1 O INVOIC.SG1[D_1153 = ”CT”].RFF.C506.1154 1.1

12 reference contract.

An identifier of a

BT- Purchase order referenced purchase

1 0.1 O INVOIC.SG1[D_1153 = ”ON”].RFF.C506.1154 1.1

13 reference order, issued by the

Buyer.

An identifier of a

BT- Sales order referenced sales

1 0.1 O INVOIC.SG1[D_1153 = ”VN”].RFF.C506.1154 1.1

14 reference order, issued by the

Seller.

Receiving An identifier of a

BT-

1 0.1 advice referenced receiving O INVOIC.SG1[D_1153 = ”ALO”].RFF.C506.1154 1.1

reference advice.

An identifier of a

BT- Despatch advice

1 0.1 referenced despatch O INVOIC.SG1[D_1153 = ”AAK”].RFF.C506.1154 1.1

16 reference

advice.

ID Level Card. BT Desc. DT Path Card. Match Rules

The identification of

BT- Tender or lot the call for tender or

1 0.1 O INVOIC.SG1[D_1153 = ”GC”].RFF.C506.1154 1.1

17 reference lot the invoice relates

to.

The identification of

BT- Invoiced object the call for tender or

1 0.1 I INVOIC.SG1[D_1153 = ”ATS”].GIR.C206.7402 1.1

18 identifier lot the invoice relates

to.

The identification

Use UN code list

BT- Scheme scheme identifier of

2 0.1 S INVOIC.SG1[D_1153 = ”ATS”].RFF.C506.1153 1.1 1153; Use ATS as

18–1 identifier the Invoiced object

default value

identifier.

A textual value that

Buyer specifies where to

BT- INVOIC.SG2[D_3035 = ”BY”].SG3[D_1153 = ”AOU”].RFF.C50

1 0.1 accounting book the relevant T 1.1

19 6.1154

reference data into the Buyer's

financial accounts.

A textual description

of the payment terms

that apply to the

amount due for

BT-

1 0.1 Payment terms payment (Including T INVOIC.FTX[D_4451 = ”AAB”].C108.4440 1.1

description of

possible

penalties).

A group of business

terms providing

textual notes that are

relevant for the

BG-1 1 0.n INVOICE NOTE invoice, together with INVOIC.FTX[D_4451 = ”GEN”] 0.99

an indication of the

note

subject.

ID Level Card. BT Desc. DT Path Card. Match Rules

Use UN code list

BT- Invoice note The subject of the 4451; GEN as

2 0.1 C INVOIC.FTX[D_4451 = ”GEN”].4451 1.1

21 subject code following textual note. default; others as

appropriate

A textual note that

gives unstructured

BT-

2 1.1 Invoice note information that is T INVOIC.FTX[D_4451 = ”GEN”].C108.4440 1.1

relevant to the

Invoice as a whole.

A group of business

terms providing

PROCESS

BG-2 1 1.1 information on the INVOIC.FTX[D_4451 = ”DOC”] 1.99

CONTROL

business process and

rules applicable to the

Identifies the

business process

context in which the

transaction appears,

BT- Business

0.1 to enable the Buyer to T INVOIC.FTX[D_4451 = ”DOC”].C107.4441 1.1

23 process type

process the Invoice in

an

appropriate way.

An identification of

the specification

containing the total

set of rules regarding

semantic content,

BT- Specification cardinalities and

2 1.1 I INVOIC.FTX[D_4451 = ”DOC”].C108.4440 1.1

24 identifier business rules

to which the data

contained in the

instance document

conforms.

ID Level Card. BT Desc. DT Path Card. Match Rules

A group of business

PRECEDING terms providing

BG-3 1 0.n INVOICE information on one or INVOIC.SG1[D_1153 = ”OI”] 0.99999

REFERENCE more preceding

Invoices.

The identification of

BT- Preceding an Invoice that was

2 1.1 O INVOIC.SG1[D_1153 = ”OI”].RFF.C506.1154 1.1

25 Invoice number previously sent by the

Seller.

Preceding The date when the

BT-

2 0.1 Invoice issue Preceding Invoice was D INVOIC.SG1[D_1153 = ”OI”].DTM.C507.2380 1.1

date issued.

A group of business

terms providing

BG-4 1 1.1 SELLER INVOIC.SG2[D_3035 = ”SE”] 1.99

information about the

Seller.

The full formal name

by which the Seller is

registered in the

BT- national registry of

2 1.1 Seller name T INVOIC.SG2[D_3035 = ”SE”].NAD.C080.3036 1.1

27 legal entities or as a

Taxable person or

otherwise trades as a

person or persons.

A name by which the

Seller is known, other

BT- Seller trading

2 0.1 than Seller name (also T INVOIC.SG2[D_3035 = ”SE”].NAD.C080.3036#2 0.1

28 name

known as Business

name).

BT- An identification of

2 0.n Seller identifier I INVOIC.SG2[D_3035 = ”SE”].NAD.C082.3039 1.1

29 the Seller.

ID Level Card. BT Desc. DT Path Card. Match Rules

Use ISO 6523 ICD

list; e.g.

0088 = Global

Seller identifier

The identification Location Number

BT- identification

3 0.1 scheme identifier of S INVOIC.SG2[D_3035 = ”SE”].NAD.C082.1131 0.1 (GLN);

29–1 scheme

the Seller identifier. 0060 = Data

identifier

Universal

Numbering

System (D-U-N-S)

An identifier issued

Seller legal by an official registrar

BT- INVOIC.SG2[D_3035 = ”SE”].SG3[D_1153 = ”GN”].RFF.C506.

2 0.1 registration that identifies the I 1.1

30 1154

identifier Seller as a legal entity

or person.

Seller legal

registration

The identification

identifier

BT- scheme identifier of INVOIC.SG2[D_3035 = ”SE”].SG3[D_1153 = ”GN”].RFF.C506.

3 0.1 identification S 1.1

30–1 the Seller legal 1153

registration identifier.

scheme

identifier

The Seller's VAT

identifier (also known

BT- Seller VAT INVOIC.SG2[D_3035 = ”SE”].SG3[D_1153 = ”VA”].RFF.C506.

2 0.1 as Seller VAT I 1.1

31 identifier 1154

identification

number).

The local

identification (defined

by the Seller’s

address) of the Seller

Seller tax

BT- for tax purposes or a INVOIC.SG2[D_3035 = ”SE”].SG3[D_1153 = ”AHP”].RFF.C50

2 0.1 registration I 1.1

32 reference that enables 6.1154

identifier

the Seller to

state his registered

tax status.

ID Level Card. BT Desc. DT Path Card. Match Rules

Seller additional Additional legal

BT-

2 0.1 legal information relevant T INVOIC.FTX[D_4451 = ”REG”].C108.4440 1.1

information for the Seller.

Identifies the Seller's

electronic address to

BT- Seller electronic INVOIC.SG2[D_3035 = ”SE”].SG5[D_3139 = ”IC”].COM.C076.

2 0.1 which a business I 1.1

34 address 3148

document may be

delivered.

Seller electronic

address The identification Use EM (= Email)

BT- identification scheme identifier of INVOIC.SG2[D_3035 = ”SE”].SG5[D_3139 = ”IC”].COM.C076. as default; look at

3 1.1 S 1.1

34–1 scheme the Seller electronic 3155 code list mapping

address for other values

identifier

A group of business

SELLER

terms providing

BG-5 2 1.1 POSTAL INVOIC.SG2[D_3035 = ”SE”].NAD 1.1

information about the

ADDRESS

address of the Seller.

BT- Seller address The main address line

3 0.1 T INVOIC.SG2[D_3035 = ”SE”].NAD.C059.3042 1.1

35 line 1 in an address.

An additional address

line in an address that

BT- Seller address can be used to give

3 0.1 T INVOIC.SG2[D_3035 = ”SE”].NAD.C059.3042#2 0.1

36 line 2 further details

supplementing the

main line.

An additional address

line in an address that

BT- Seller address can be used to give

0.1 T INVOIC.SG2[D_3035 = ”SE”].NAD.C059.3042#3 0.1

162 line 3 further details

supplementing the

main line.

ID Level Card. BT Desc. DT Path Card. Match Rules

The common name of

the city, town or

BT-

3 0.1 Seller city village, where the T INVOIC.SG2[D_3035 = ”SE”].NAD.3164 0.1

Seller address is

located.

The identifier for an

addressable group of

BT-

3 0.1 Seller post code properties according T INVOIC.SG2[D_3035 = ”SE”].NAD.3251 0.1

to the relevant postal

service.

BT- Seller country The subdivision of a

3 0.1 T INVOIC.SG2[D_3035 = ”SE”].NAD.C819.3228 0.1

39 subdivision country.

BT- Seller country A code that identifies

3 1.1 C INVOIC.SG2[D_3035 = ”SE”].NAD.3207 0.1 CAR-2

40 code the country.

A group of business

SELLER terms providing

BG-6 2 0.1 INVOIC.SG2[D_3035 = ”SE”].SG5[D_3139 = ”SU”] 0.5

CONTACT contact information

about the Seller.s

BT- Seller contact A contact point for a INVOIC.SG2[D_3035 = ”SE”].SG5[D_3139 = ”SU”].CTA.C056.

3 0.1 T 1.1

41 point legal entity or person. 3412

...

Questions, Comments and Discussion

Ask us and Technical Secretary will try to provide an answer. You can facilitate discussion about the standard in here.

Loading comments...